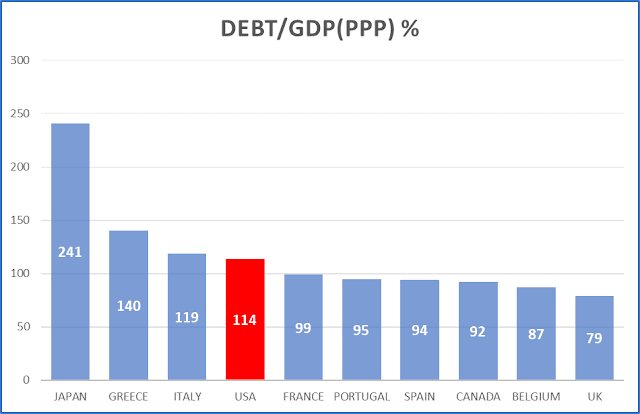

Note: Numbers on Debt/GDP below have been calculated using GDP on a Purchasing Power Parity (PPP) basis. Also, I have removed countries such as Lebanon, Suriname, Sudan, etc. from the chart.

__________________________________________________________________________

When it comes to Debt/GDP Japan is the undisputed "champion" - but most all of its debt is domestic. Only 6.5% of all debt is owed to foreigners, while the vast majority (52%) is held by the Bank of Japan. This has significant global repercussions, but Japan is not my subject today.

Number two on the rogues list is Greece - no surprise there - but unlike Japan most all of its debt is owed to foreign official sector lenders. The bad news here is that this debt load exists even after the country went bankrupt a decade ago and plunged its economy into a decade long depression. But Greece is also not my subject today.

Numero tre is Italy. A perennial problem child, the only reason Italy can still finance itself at reasonable interest rates is that its Eurozone membership is presumed to preclude a bankruptcy. Let me point out, however, that as recently as 2008 its debt/GDP(PPP) was ca. 70%. But Italy, too, is not my subject today.

My subject today is the USA - not a shock to regular readers of this blog going back as far as 2006. And my main question here is this: how logical, or even safe for the global economy, is it that the issuer of the world's reserve currency is so heavily in debt? Indeed, what does this mean for the US dollar when its issuer is the world's #4 most indebted economy?

Sure, under our current fiat currency regime, where debt is money and money is debt, it is expected that the availability of the global reserve currency can only come from a country that has a commensurately high debt.

But at which point does the debt load finances mostly domestic consumer spending of cheap imports (eg China) and defense spending, instead of productive, high value added activities? At which point does the incessant printing/borrowing become a vicious cycle?

Hint: the crypto boom is stoked to a large extent by those who look at such statistics and rub their hands in glee. I do not share their glee because if we go down that route we are opening a much worse Pandora's Box - no need to enumerate all the nasty stuff that will come out from the Crypto Box.

But... something must be done to contain the US propensity to borrow and spend with abandon as if "tomorrow never comes, la, la, la". Because, unlike in the song, tomorrow always comes.

Let me try to quantify the debt excess, even if roughly: the US accounts for approx. 16% of global GDP(PPP), but its government debt stands at ca. 35% of global government debt. In other words, the US is twice as indebted when measured against its global economic size.